Rrsp Limit For 2024 – Additionally, any gains made in an RRSP are also tax-deferred, so you only pay tax on funds when they are withdrawn. Keep in mind that because RRSPs have so many tax-related benefits, they do have an . When an RRSP contribution is made, there’s no requirement to claim the deduction that year. If you’re expecting your salary to increase significantly in the next couple years, you could maximize tax .

Rrsp Limit For 2024

Source : www.incometaxgujarat.orgWhat is the Maximum RRSP Contribution for 2024

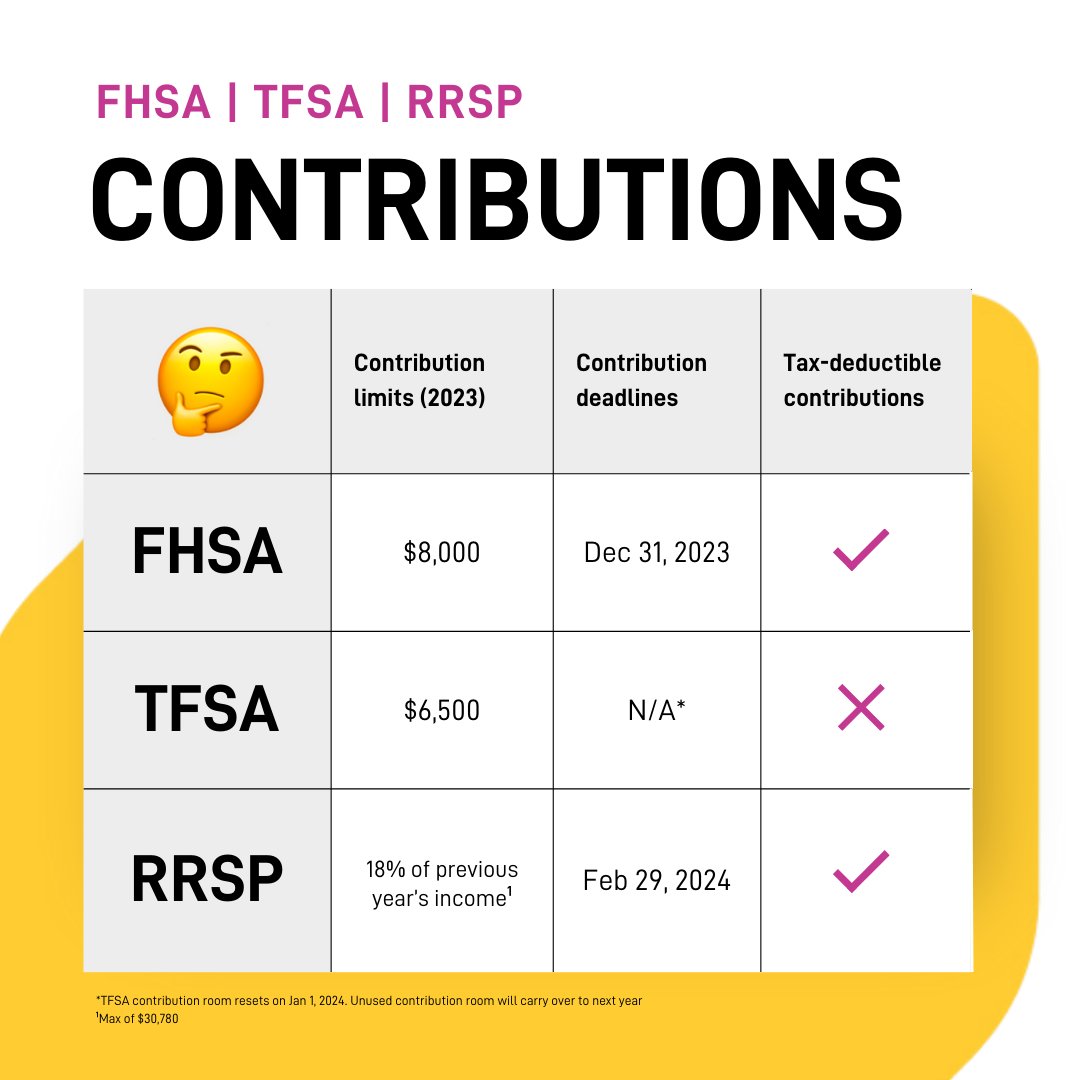

Source : www.canadianlic.comPolish Credit Union The 2023 RRSP deadline is February 29, 2024

Source : m.facebook.comRRSP Dollar Limit for 2024 | ETFs

Source : harvestportfolios.comKBH Chartered Professional Accountants on LinkedIn: #teamtuesday

Source : www.linkedin.comNew to investing, do I buy XEQT in my RRSP or TFSA first? : r

Source : www.reddit.comEQ Bank on X: “Optimize your money’s potential—be in the know of

Source : twitter.comStrata Mortgages Inc. on LinkedIn: #taxprep #stayorganized

Source : www.linkedin.comMelkonian Finance | Ville Saint Laurent QC

Source : www.facebook.comAlex Melkonian Melkonian Finance | LinkedIn

Source : ca.linkedin.comRrsp Limit For 2024 RRSP Contribution Limit 2024: What is RRSP Contribution Limit and : The deadline to contribute to the registered retirement savings plan (RRSP) is coming up, but a new option to lower taxable income while saving for a home complicates the decision. . Find out your current registered retirement savings plan (RRSP) contribution limit by using this calculator. Your RRSP contribution limit is based on the maximum annual RRSP contribution room set .

]]>